Why Invest in Dividend Stocks for Passive Income

In the ever-changing realm of financial planning and building wealth Few strategies have stood in the face of time as well as the dividend stock investment. If you’re an experienced investor or are just beginning your journey dividend stocks are an effective way to earn passive income, protect capital, and help build the long-term wealth. What is a dividend stock and why are you considering including them in your portfolio?

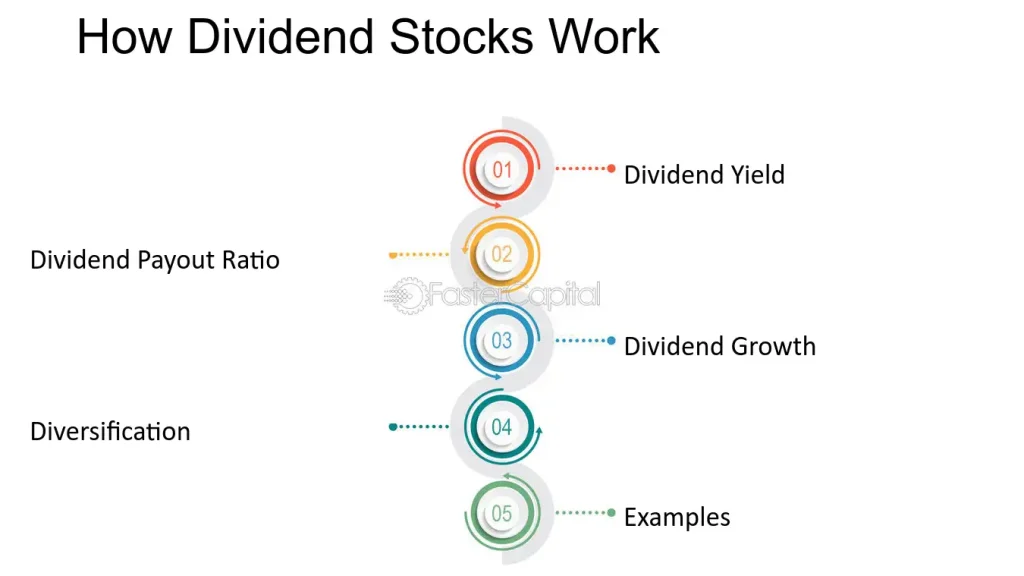

What Are Dividend Stocks

Dividend stocks are the shares of companies that frequently pay some of their profits towards shareholders through the method dividends. They are typically paid every quarter and are an ongoing source of income especially from companies that have a solid track records that shows financial security and stable performance.

1. Reliable Source of Passive Income

One of the strongest motives to consider investing in dividend-paying stocks are the income that they generate passively. Contrary to growth stocks, which require the sale of shares in order to make gains dividend stocks pay you as long as you keep them. The dividends can be used to augment your income, help pay the cost of living or be reinvested to boost your wealth building journey.

For retirees, dividends is a reliable cash flow, which doesn’t require liquidating investment assets — an important benefit in volatile markets.

2. Compounding Through Dividend Reinvestment

If you invest dividends rather than spending them, you profit from the ability of compounding. In time, dividends that are reinvested are used to purchase additional shares, which then produce more dividends. This effect of snowballs can drastically boost your returns overall particularly in tax-advantaged accounts such as IRAs as well as 401(k)s.

3. Lower Volatility and Defensive Nature

Companies that pay dividends are usually solid, financial stable as well as less volatile than their high-growth counterparts. They are typically found in areas such as consumer staples, utilities and healthcare — sectors which are resilient even in recessions in the economy. This is why dividend stocks are a good choice for investors who are conservative or those who want to protect themselves against the volatility of markets.

4. Inflation Protection

Although fixed-income investments such as bonds may lose their value in times of inflation as dividend-paying companies typically increase their payouts over the course of time. This can assist investors to maintain or increase their income, even when the cost of living increases providing a degree of security against inflation.

5. Total Return Enhancement

The term “total return” refers to the sum of capital appreciation and the income from dividends. In the long-term dividends have always played a significant role in the return on investment of stock markets. Companies that increase their dividends regularly are more focused and focused on providing shareholder value, which can result in higher long-term results.

6. Tax Advantages (in Some Jurisdictions)

In several countries where qualified dividends are taxed at lower rates than normal income. This makes dividends more appealing from a tax efficiency perspective, especially for high income earners who want to reduce the tax burden. Always consult an expert tax advisor for more details dependent on where you are.

Things to Consider Before Investing

Although dividend stocks have numerous benefits, they’re also not without risk. Companies can reduce their dividend during times of uncertainty and seeking high yields may cause poor investment choices. It’s crucial to investigate the fundamentals of the company, its dividend payout ratios and history prior to committing capital.

Final Thoughts

Dividend stocks provide a unique combination of stability, income as well as long-term growth possibilities. For those looking to establish a steady stream of income that is passive they are a tried-and-true strategy that is able to withstand markets’ ups and downs. If you’re thinking about retirement or creating wealth, or trying to increase the efficiency of your money for you, dividend investing should have an area in your financial toolbox